Your future pension rights are under pressure

From Mnd

Something strange is going on.

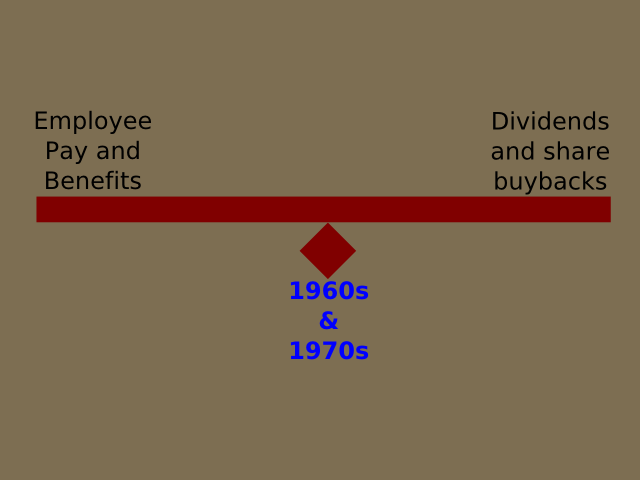

In the 1960s and 1970s, the competing claims of the shareholder and the employee seemed more fairly balanced. The shareholder seemed to appreciate that, to get the best out of the employees, they needed to be well-rewarded – not just in pay, but in benefits as well. A well-paid employee was also a well-paid consumer, who would push his or her income back into the economic system, and thus play their part in a hopefully virtuous cycle of growth.

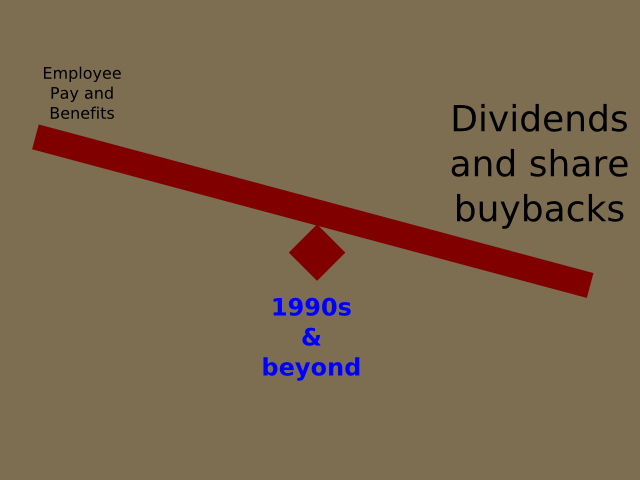

But since the 1990s, the power has swung strongly in favour of the shareholder, particularly in countries which promote the so-called Anglo-Saxon business model, such as the UK and America. In this system, the claims of the shareholder on the company’s revenues seem to trump the claims of the employee. The system is configured so that the company's top executives tend also to be major shareholders, to ensure that they identify keenly with the interests of the shareholder.

Many company initiatives are proclaimed in the interests of the shareholder. The company's pension benefits have to be reduced, for example, in order to satisfy shareholders.

And yet the largest shareholders, by size of holding, are actually pension funds themselves. So pensioners are seeing their benefits cut in order, apparently, to please other pensioners. Something is clearly wrong. If pensioners acted in a concerted way, they would not want companies to cut pension benefits.

Why is this not happening? Is it that pensioners are not good at organising themselves, and representing their combined interests?

Or is it that, although executives may sincerely believe they are acting in the interests of shareholders in general, they are actually acting in the interests of a specific class of shareholders—namely themselves?