Peak Oil

From Lauraibm

Contents |

MI Summary

Peak Oil

Peak oil is a theory devised by M. King Hubbert, concerning the long-term rate of conventional oil depletion. In 1974, he predicted that peak oil would happen in 1995 "if current trends continue".

The theory predicts that the world's oil production will reach a peak and then rapidly decline. Some people believe that we have already reached the peak—i.e. that the world will never again be able to pump as much oil as we are pumping today. Some optimists still believe the peak will not come until 2020.

Demand for crude oil demand has been growing, especially in the developing countries, particularly in India and China, with most of it used for transportation.

Most of the easy-to-extract oil has already been found. However the development of the Canadian tar sands and the success of America's enhanced oil recovery technqiues give some grounds for hope.

But the world is approaching the end of the age of oil, whether the peak is here already or is 12 years away.

Text of Article

Are these the last days of the Oil Age?

written by William Rees-Mogg

Oil ruled the 20th century; the shortage of oil will rule the 21st. There is now no doubt about the rising trend in oil prices. In 2003 a barrel of Brent crude sold for $29; in 2004 it rose to $38; in 2005 it rose to $54.50; in 2006 it rose to $65. Last Friday the price closed at $77.50. Some dealers expect it to test the $80 level quite shortly.

Last Tuesday the lead story in The Financial Times was the latest report from the International Energy Agency. The FT quoted the IEA as saying: “Oil looks extremely tight in five years’ time,” and that there are “prospects of even tighter natural gas markets at the turn of the decade”. For an international agency, that is inflammatory language. This steep rise in the oil price over a four-year period has been caused by demand rising at more than 2 per cent a year, while supplies had risen more slowly, by a healthy 4.1 per cent in 2004, but by only 1.25 per cent in 2005 and 0.5 per cent in 2006.

This has revived the “oil peak” debate among oil analysts. Some analysts believe that the world will never again be able to pump as much oil as we are pumping at present.

Peter Warburton’s excellent weekly risk analysis has pointed out that 27 of the 51 oil-producing nations listed in BP’s Statistical Review of World Energy reported output declines in 2006. One projection of world crude oil production actually forecasts a 10 per cent reduction in total world output between 2005 and 2015. That would be a revolution.

The oil peak debate can be left to the oil analysts. It is a complex issue, and there are some grounds for questioning the most pessimistic forecasts, including the likely development of the Canadian tar sands, and the success of American enhanced oil recovery techniques. Past forecasts of oil depletion have often proved wrong, and the present forecasts are uncertain. Nuclear power could increase energy supply, but a big nuclear programme has been left far too late in most countries.

The five-year view taken by the IEA is itself a central forecast. Some analysts think that the peak oil moment has already been reached; some still think that it will not come until 2020 – which is itself only 12 years away. Market trends and the statistics both support the IEA’s view that consumption is accelerating and supplies falling faster than expected. Of course, if the “crunch” point is only five years’ away for oil, and closer for natural gas, it has, for practical purposes, already arrived.

Those of us who remember the 1970s and early 1980s know how damaging the oil shocks were. They postponed the economic hopes of more than a decade, from 1974 to 1985. The rise of the oil price led to global inflation; at one point, around 1980, it looked as though global inflation could tip over into global hyper-inflation.

In the democracies, governments lost elections; in the Soviet Union, their regime was rocked. If governments found things very difficult, so did private individuals. Unemployment rose and the trade unions became very militant.

Investors were caught in a trap of rising nominal values but falling real values. In the property market, house prices rose, but the general price level rose even faster. For the first ten years of the inflation, gold proved to be a hedge and a protection; but this was followed by a period when the real purchasing power of gold was falling. Most people became poorer, except for those with access to oil money, but some became much poorer, much more quickly. Life became more of a gamble and societies became less stable. All this happened at a time when the supply of oil was being artificially restricted by the Opec oil cartel. There was no absolute shortage of oil, though analysts already knew that the oil peak would happen eventually. Now the situation has moved from a political problem, open to political settlement, to an absolute geological shortage. For the future, oil supply will be a zero-sum game. Some nations will be “haves” but others will be “have nots”.

The shortage of oil and natural gas, relative to demand, had already changed the balance of world power. Historians may well conclude that the US decision to invade Iraq was primarily motivated by the desire to gain physical control of Iraq’s oil and to provide defence support to other Middle Eastern oil powers. Political motivations are always mixed, but oil is an essential national interest of the United States. If the US is now deciding to withdraw from Iraq, the price will have to be paid in terms of loss of access to oil.

Russia, the leading producer of natural gas and one of the two leading oil producers, is the global winner. President Putin has already used oil and gas as a diplomatic weapon. The relationship between the European Union and Russia will naturally be influenced by increasing European dependence on Russian oil and gas. Germany may well turn towards Russia, out of weakness. The oil shocks of the 1970s had different effects on different European countries. Britain had some North Sea oil and the prospect of more, as did Norway. Germany and France had little or no oil of their own. Differential shocks in the coming period of oil shortage will make it harder to maintain the euro-zone. Differential shocks are a threat to single-currency systems.

The world is coming to the end of the age of oil, which produced its own technology, its balance of power, its own economy, its pattern of society. It does not greatly matter whether the oil supply has peaked already or is going to peak in five or 12 years’ time. There is a huge adjustment to be made. There will be some benefits, including higher efficiencies and perhaps a better approach to global warming. But nothing will take us back towards the innocent expectation of indefinite expansion of the first months of the new millennium.

(1)

Wikipedia: Peak Oil

In the context of Hubbert peak theory, peak oil is the date when the peak of the world's conventional petroleum (crude oil) production rate is reached. After this date the rate of production is predicted to enter terminal decline, following the bell-shaped curve predicted by the theory.

Some observers such as Kenneth S. Deffeyes, Matthew Simmons, and James Howard Kunstler believe that because of the high dependence of most modern industrial transport, agricultural and industrial systems on inexpensive oil, the post-peak production decline and possible resulting severe price increases will have negative implications for the future outlook of the global economy. Predictions as to what exactly this negative effect will be vary wildly. More positive outlooks, putting the peak of production in the 2020s or 2030s show the price at first escalate and then retreat as other types of fuel sources are used as transport fuels and fuel substitution in general occurs. More dire predictions which operate on the thesis that the peak will occur shortly or has already occurred predict a global depression and even the collapse of industrial global civilization as the various feedback mechanisms of the global market cause a disastrous chain reaction. The shortfall will either have to be mitigated through conservation or through alternatives.

Timing

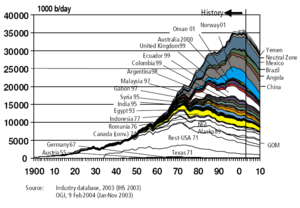

The only reliable way to identify the timing of peak oil will be in retrospect. M. King Hubbert, who devised the peak theory, predicted in 1974 that peak oil would occur in 1995 at 12-GB/yr "if current trends continue". However, in the late 1970s and early 1980s, global oil consumption actually dropped (due to the shift to energy efficient cars, the shift to electricity and natural gas for heating, etc.), then rebounded to a lower level of growth in the mid 1980s (see chart on right). The shift to reduced consumption in these areas meant that the projection assumptions were not realized and, hence, oil production did not peak in 1995, and has climbed to more than double the rate initially projected.

Colin Campbell of the Association for the Study of Peak Oil and Gas (ASPO) has suggested that the global production of conventional oil peaked in the spring of 2004 albeit at a rate of 23-GB/yr, not Hubbert's 13-GB/yr. During 2004, approximately 24 billion barrels of conventional oil was produced out of the total of 30 billion barrels of oil; the remaining 6 billion barrels coming from heavy oil and tar sands, deep water oil fields, and natural gas liquids (see adjacent ASPO graph). In 2005, the ASPO revised its prediction for the peak in world oil production, again, from both conventional and non conventional sources, to the year 2010. These consistent upward (into the future) revisions are expected in models which don't take into account continually increasing reserve estimates in older accumulations.

Another peak oil proponent Kenneth S. Deffeyes predicted in his book Beyond Oil - The View From Hubbert's Peak that global oil production would hit a peak on Thanksgiving Day 2005 (Deffeyes has since revised his claim, and now argues that world oil production peaked on December 16, 2005)

Texas oilman T. Boone Pickens has stated that worldwide conventional oil production will top out at 84 MB/day (31 BB/yr).

Colin Campbell, a well-known petroleum geologist, has put the tilting point at 2010. The U.S. Department of Energy predicts that the peak won't happen until 2037.

Peak oil is concerned with the production flow of oil measured as the quantity extracted over time. Recoverable reserves are important only in that they must exist before any oil can be extracted and delivered to the market.

Supply

Reserves

Conventionally reservoired crude oil resources comprise all crude oil that is technically producible from reservoirs through a well bore using any primary, secondary, improved, enhanced, or tertiary method. Not included are liquids from mined deposits (tar sands; oil shales) or created liquids (gas-to-liquids; coal oil).

Oil reserves are classified into categories - proven, probable and possible. Proven reserves are thought to be "Reasonably Certain" to be producible using current technology at current prices and are about 90% certain of being produced. The "Probable Reserves" category has a probability of 50% and the "Possible Reserves" has a probability of 10%.

Most of the easy-to-extract oil has been found. Recent oil exploration is being carried out in areas where oil is much more expensive to extract, extremely deep wells, extreme downhole temperatures, environmentally sensitive areas or where high-technology will be required to extract the oil. Oil companies such as Exxon Mobil, Shell, and BP are having to spend more money on oil exploration due to a shortage of drilling rigs, increases in steel, an increase in service charges - like drilling rig rates, and overall increases in costs due to complexity.

Quantifying reserves

In forecasting the date of peak oil - and in testing the validity of Hubbert's theory - one difficulty is the strong opacity surrounding the claimed proven oil reserves. This was best exemplified by the scandal surrounding the 'evaporation' of 20% of Shell's reserves. For the most part, proven reserves numbers come from the three major players of the oil market: the oil companies, the producer states and the consumer states. All three have an interest to inflate their proven reserves: oil companies see their potential worth augmented as much; producer countries are bestowed a stronger international stature; and governments of consumer countries aren't keen on sending alarming signals to their economies and consumers. Many worrying signs concerning the depletion of 'proven reserves' have emerged in recent years.

Unconventional sources

Unconventional sources, such as heavy crude oil, tar sands, and oil shale are not counted as part of oil reserves until oil companies can book them as proven reserves after they finish a strip mine or thermal facility to extract them. The three major sources of unconventional oil are the extra heavy oil in the Orinoco province of Venezuela, the tar sands in the Western Canada Basin, and the oil shale in the Green River Formation in Colorado, Utah and Wyoming in the United States. It is estimated that these sources account for as much oil as the reserves of the Middle East.

Some experts say that all the world’s extra oil supply is likely to come from expensive and environmentally damaging unconventional sources within 15 years, according to a detailed study. This will mean increasing reliance on these hard-to-develop unconventional sources of energy. The downside is that these resources are typically full of contaminants and energy intensive to extract. To make them usable as transportation fuels, sulfur, heavy metals and carbon must be removed.

Demand

The demand side of Peak oil is concerned with the consumption of oil measured as the quantity consumed over time. World crude oil demand has been growing at an annualized compound rate around 2 percent in recent years. Demand growth is highest in the developing world, particularly in China and India, and to a lesser extent in Africa and South America. Where high demand growth exists it is primarily due to rapidly rising consumer demand for transportation via cars and trucks powered with internal combustion engines.

The U.S. Department of Energy categorizes national energy use in four broad sectors: transportation, residential, commercial, and industrial. In the United States, in contrast to other regions of the world, about 2/3 of all oil use is for transportation, 1/5 goes to industrial uses, and the remainder goes to residential, commercial and electric energy production.

Transportation

Most oil is consumed in transportation, approximately 66.6% in the United States and 55% worldwide, World demand for oil is set to increase 37% by 2030, according to the US-based Energy Information Administration's (EIA) annual report. Demand will hit 118 million barrels per day from today's existing 86 million barrels, driven in large part by transport needs.

Population

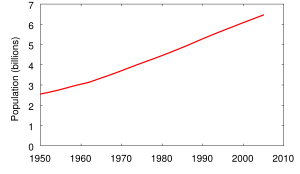

Because of world population growth, oil production per capita peaked in the 1970s. It is expected that worldwide oil production in the year 2030 will decline to the same level as it was in 1980. The world’s population in 2030 is expected to double from 1980 and much more industrialized and oil-dependent than it was in 1980. Consequently, worldwide demand for oil will significantly outpace worldwide production of oil.

One factor that may ameliorate this effect is the rapid decline of population growth rate since the 1970. In 1970, the population growth rate was 2.1%. By 2006, this had declined to 1.1%. Meanwhile, oil production has continued to grow strongly. From 2000 to 2005, human population only grew by 6.3%, whereas global oil production increased by 8.2% .

Some physicists maintain that the non-sustainability of oil production per capita was not addressed due political correctness implications of suggesting population control.

Supplies of oil and gas are essential to modern agriculture, so coming decades could see spiraling food prices without relief and massive starvation on a global level such as never experienced before. Geologist Dale Allen Pfeiffer claims that to achieve a sustainable economy and avert disaster, the United States must reduce its population by at least one-third, and world population will have to be reduced by two-thirds. Current U.S. population of more than 300 million and world population exceeding 6.6 billion is, according to Pfeiffer, unsustainable.

Industrialization

As countries develop, industry, rapid urbanization and higher living standards drive up energy use markedly. The energy supply to drive industrialization mostly comes from oil. For example, thriving economies such as China and India are quickly becoming large consumers of oil. China today imports roughly half its oil. Consumption rose by 15% in 2005 and increased again by 9% in 2006. It is expected China will double its oil consumption by 2025. China will burn through 14.2 million barrels a day. India's oil imports are expected to more than triple to some 5 million barrels a day by 2020. Cars and trucks will cause almost 75% of the increase in oil consumption by India and China between 2001 and 2025. As more countries develop, the demand for oil also increases.

(2)

Source

- 2. Wikipedia